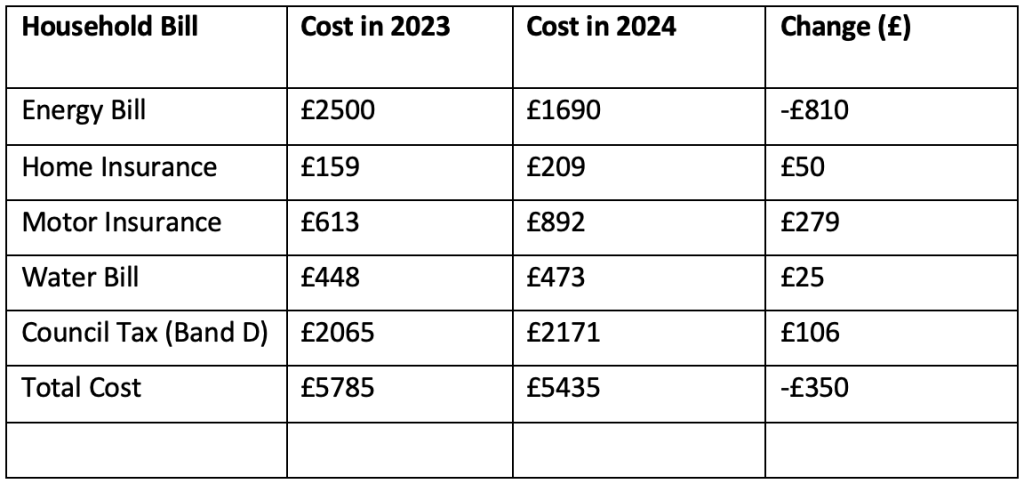

In a welcomed relief for UK households, the annual cost of household bills is anticipated to decrease by an average of £350 year-on-year starting April 2024, reveals new research conducted by Compare the Market. The study, which scrutinizes expenses like energy, water, home and motor insurance, and council tax, forecasts a collective 6% reduction in these bills compared to the previous 12 months.

The primary factor contributing to this decline is a forthcoming decrease in energy costs. Ofgem’s latest price cap, slated to take effect in April, will see a typical household paying £1,690 per year, marking an £810 reduction from the previous year under the £2,500 Energy Price Guarantee enforced in April 2023.

However, amidst this positive trend, the study notes a rise in other household expenditures over the past year. Car insurance costs have surged by £279 year-on-year in February, while home insurance has seen a £50 increase during the same period. Additionally, council tax for Band D properties is expected to climb by an average of £106, and water bills will rise by £25. Collectively, these expenses add up to £460 more than the previous year. Furthermore, broadband, TV, and mobile phone bills are set to increase in April in line with inflation.

Despite the decrease in energy bills, many households are still grappling with financial strain. The report highlights that, on average, households could be shelling out £5,435 annually for regular bills starting April 2024, down from £5,785 the previous year. However, this remains £397 higher than the cost in 2022, exacerbating the financial challenges faced by many. According to a separate survey by Compare the Market, one in five individuals only managed to make the minimum repayment on their latest credit card bill, underscoring the growing burden of the cost-of-living crisis.

Given these dynamics, consumers are urged to seek savings wherever possible. Compare the Market suggests potential savings of up to £779 on car and home insurance combined, including up to £578 on car insurance and up to £201 on home insurance. Moreover, a third of customers could save £186 by purchasing broadband through Compare the Market.

Andy Hancock, Chief Growth Officer at Compare the Market, emphasizes the importance of savvy financial management: “The predicted fall in annual bills overall is a rare piece of good news following the continuous long-standing pressure on household budgets.” He underscores the significance of comparing deals on regular bills and exploring opportunities for savings, given the persistent challenges faced by consumers in navigating their finances.

In summary, while the anticipated reduction in household bills offers some respite, consumers are advised to remain vigilant and proactive in managing their finances to mitigate the impact of rising costs in other areas.

[Note: The table below provides a breakdown of the expected changes in various household bills from 2023 to 2024.]