Choosing A Reputable Payday Loan Lender

It can be difficult to choose the right payday loan lender; you have to be cautious over whether you’re getting involved in the right deal, while also making sure that you’re not being drawn into paying very high amounts of interests or charges. Some payday loan providers will also be less reputable than others due to not conforming to regulations over transparency when lending. Given the large number of payday lenders out there, what should you be focusing on when trying to make a decision over which one to choose? Moreover, what counts as a reputable payday lender, and which companies should you try avoid?

It can be difficult to choose the right payday loan lender; you have to be cautious over whether you’re getting involved in the right deal, while also making sure that you’re not being drawn into paying very high amounts of interests or charges. Some payday loan providers will also be less reputable than others due to not conforming to regulations over transparency when lending. Given the large number of payday lenders out there, what should you be focusing on when trying to make a decision over which one to choose? Moreover, what counts as a reputable payday lender, and which companies should you try avoid?

Primarily, it’s important to remember that any kind of payday loan agreement is going to involve some form of risk. When borrowing small amounts of money in the short term, and then making repayments, you have to be able to cover both the initial principle of the loan, and any subsequent interest and fees. Payday and short term loans are typically taken out to cover emergencies, with the understanding that you’ll be able to cover the deficit created within the month.

You should always check to see whether a payday loan provider is properly covered by different regulations - their websites should demonstrate affiliations and terms and conditions. Payday lenders should be regulated by the Consumer Credit Acts of 1974 and 2006, as well as by the Office of Fair Trading. At the same time, more and more payday lenders are coming under scrutiny from organisations like the Financial Conduct Authority to advertise their full fees.

In this way, it’s important to look for a payday loan provider that has a clear customer charter, and that are committed to providing up to date information on their loans. Lenders that have relationships with the BCCA and the Finance & Leasing Association can also be deemed as reputable, and will be able to present information as to what would happen if you had to complain about being mistreated during a loan agreement. Contact details for the financial ombudsman should similarly be listed on a lender’s website.

You want to compare the market as much as possible before deciding on a payday lender. Going for companies that are part of larger organisations can make it easier to avoid the risk of being hit by scam companies that are unregulated, and that will stuff their loans with hidden fees and charges that can make it very difficult to repay your initial borrowing within a short period of time. Generally, you should always check whether a payday lending site is mentioned elsewhere online, as well as how long it has been in business for, and whether it includes comprehensive contact details and terms and conditions.

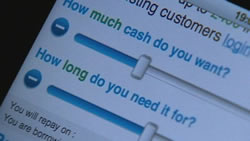

One option that you should explore when getting a loan is using comparison sites that can bring together deals from lots of different payday lenders. SwiftMoney, for example, allows you to submit a loan application that’s then forwarded to different lenders, providing you with the opportunity to find the best possible rate of interest and repayment plan for your needs. Applications can also be quickly completed online.

By following these approaches, it’s possible to find a reputable payday loan company that won’t hit you with any unfair charges. While you will have to accept some forms of risk, you can make things much easier on yourself when borrowing by looking at companies that have transparent terms and conditions, as well as several different options for applying for and receiving a short term loan. Taking the time to compare the market can allow you to see what different loans are available, as well as which companies are prepared to be flexible over repayments and fees.

Representative

Exapmle

Borrow £250 For 30 Days

| Total repayment: | £310.00 |

|---|---|

| Interest rate p.a: | 292.25%(fixed) |

| Interest payable: | £60.00 |

Representative 815.74% APR (variable)