Swift Money - Consumer Trends Research

How have our spending habits waxed and waned over recent years?

How have our spending habits waxed and waned over recent years?The severe late 2000s recession that forced so many of us to significantly tighten our belts may be a thing of the past, but even in the year 2016, we are hardly back in a position of splashing the cash.

That is the conclusion of new research by instant payday loan specialist Swift Money, which found that despite the UK's recent apparent economic resurgence, total expenditure by consumers has remained largely stable since 2005.

Intriguingly, this also indicates that we didn't clamp down on our overall spending back in 2008 quite as drastically as you'd think, instead simply prioritising other areas of expenditure.

What the statistics say about how we spend and live

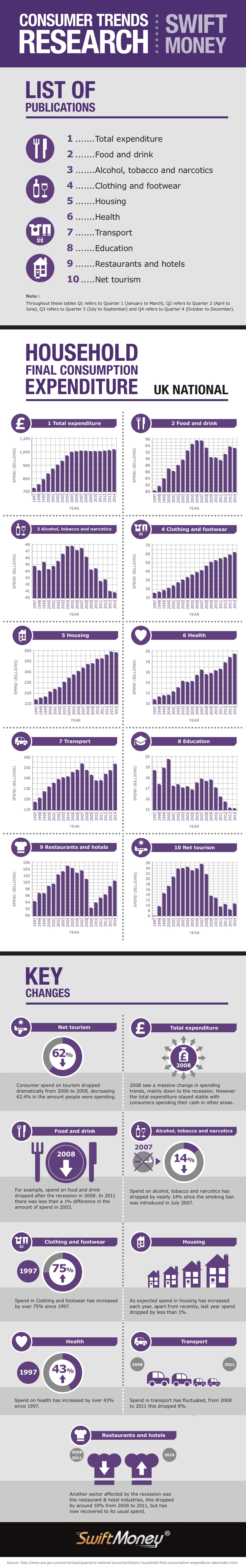

Below, we have published an infographic giving an overview of our findings, covering various areas of consumer spending across the UK over the last two decades.

There are certainly a few surprises in the graphs - who would have thought, for instance, that education expenditure would see such a drastic fall from its peak of almost £20 billion in 2000, to only just over £15 billion in 2014? Or that net tourism spending in the most recent year of the survey would be so far below that of even the recession-hit 2009?

Some of the drops in spending since 2008 could be reasonably presumed to be due to the economic slowdown and UK residents having fewer pounds in their pockets. However, that isn't necessarily the full story - expenditure on alcohol, tobacco and narcotics, for instance, has generally been on the slide since the smoking ban's introduction in July 2007.

Spending on the up in a whole range of areas

Unsurprisingly, given the constant newspaper headlines suggesting how many of us are being squeezed by a combination of ever-rising living costs and tightening salaries, our research found steep increases in many areas.

Spending on clothing and footwear, for instance, has been steadily rising since 1997, and is now more than 75% higher than it was back then. Health-related expenditure has also continued to spiral, by over 43% since 1997.

Then, there's the not-insignificant matter of housing, with every year in the survey except 2014 having recorded an increase in this area. Even that year, the drop in spend was less than 1%, which might merely indicate that we have briefly hit an 'affordability ceiling', rather than that it has actually become any cheaper to keep a roof over our heads.

The more things change, the more they stay the same...

Thankfully, there were at least some stats gleaned from our research that suggested relative stability in spending levels, or even fairly good news.

Transport spending, for instance, was basically the same in 2014 as it was in 2006, indicating that many of us may be learning to get onto our bikes rather than always depend on the car. The categories of 'food and drink' and 'restaurants and hotels', meanwhile, both recorded major recession-assisted drops from 2008-9, but have since seen at least partial recovery.

What do you make of these findings? Do they reflect the changes in your own household budget since 2008, or have you discovered other useful ways to save money that have prevented the need for you to significantly compromise your lifestyle? Feel free to let us know below.