The Cost Of Living In The UK vs Wages

As house prices and rents escalate, payday loans have never been so vital

As house prices and rents escalate, payday loans have never been so vitalIt's easy to forget, particularly if you are lucky enough to be on a steady financial footing, just how important payday loans remain for those who do not have great disposable income. Perhaps you are one of those people, very much 'robbing Peter to pay Paul' every month and constantly in need of that quick cash injection to get you over the line?

Whatever your own situation, here is the perfect visual demonstration of precisely how much of a struggle it can be to pay your own way in Britain today. Far from the work-shy shirkers, scroungers or just plain old lazy that many of those on lower incomes have sometimes been portrayed as, such workers are fighting against spiralling living costs in all parts of the country. Sadly, the trend indicates that this will not cease to be the case anytime soon.

Scroll down to read our infographic on house prices, rent values and wages in the UK today, based on figures sourced from Shelter, indicating just how crucial payday loans still are for so many Britons.

Are you looking to buy a home?

Home ownership remains one of the most coveted dreams for Britons - but the statistics show that up and down the country, it is also becoming an unobtainable one.

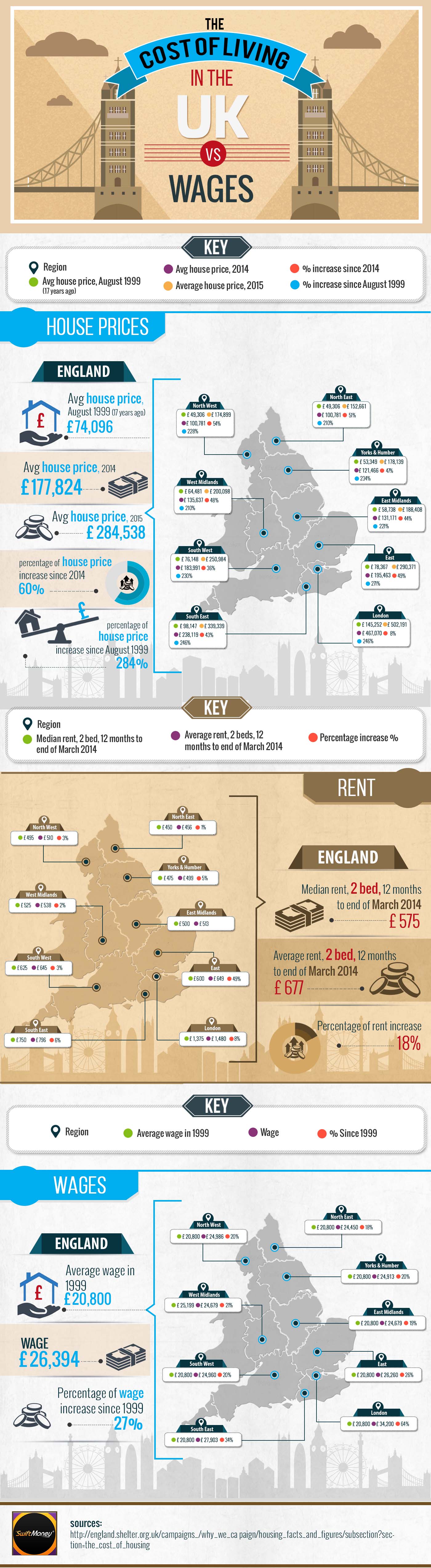

Whereas average house prices in England were just £74,096 in August 1999, as of 2014, they had risen to £177,824 and just a year later, were at an incredible £284,538. That equates to an astonishing 60% increase in house prices in England since 2014, and 284% since August 1999.

At least there's always renting...

...or is there? After all, this is another crucial area in which Brits are being squeezed. The median rent for a two-bedroom property in the 12 months to the end of March 2014 was £575, with the average rent for that same period being £677.

Naturally, the picture does vary across the regions. In the North East, you might expect to pay a median rent of £450 or an average rent of £456 for a two-bedroom property, whereas in London, those figures are £1,375 and £1,480 respectively.

A story of wages struggling to keep up

So, now you've read about how costly it is in today's England to afford to rent or purchase a property outright - but have your wages risen enough over the years to compensate for the ever-heightening costs? The short answer is, almost certainly not. This isn't to suggest that wages haven't gone up over the years, with the average salary in England having heightened by 27%, from £20,800 in 1999 to £26,394 now. However, such an increase is well shy of how far living costs have shot up.

In London, this epidemic isn't such a surprise, being widely reported in the news, although the sheer scale of the problem as demonstrated by the hard figures may still take you aback. Despite the increase in Londoners' wages since 1999 easily shadowing those in the rest of the UK - from £20,800 to £34,200, a whopping 60% rise - those wishing to buy a home in the capital are compromised by a staggering 246% increase in prices in the same period. As of 2015, they could expect to pay an overwhelming £502,191 for a property to call their own.

But it's not just in the costlier parts of the UK where there are real affordability problems. The average North Easterner, after all, has only seen 18% added to their pay packet since 1999, bringing it from £20,800 to £24,450. However, if they wish to purchase a home, they can expect to be charged an average of £152,661 - a 210% rise in the last 17 years, and 51% higher than they would have paid even as recently as 2014.

The cost of living in the UK - an unavoidable problem

In the face of the figures, then, it is almost impossible for anyone to deny that we face a real and intensifying cost-of-living crisis in this country. Within just a few short years, the epidemic has reached dire proportions, forcing many UK homeowners and renters to take desperate measures to keep themselves financially afloat.

It is easy to see, then, just what a vital role payday loans have continued to play in this country in recent times. Now subject to tighter regulation, payday loans have become a truly reputable and mainstream means by which all manner of people have got themselves from one payday to the next.

Take your next payday loan with our experts here at Swift Money, and you really can help to ensure that you keep yourself in good financial health in these extremely challenging times for hardworking, low-income people across the UK.