Payday Loan Charges: What You Need to Know

Representing short term loans that have to be repaid within a limited period of time, payday loans can be a good idea if you need access to funds fast. Payday loans are typically offered in amounts of between £50 to £1,000, but with the expectation that you’ll pay high APR charges, as well as broker fees in some instances. These kinds of loans can be useful in emergency situations, as well as when you need money for a specific reason, and know that you can make repayments in a reasonable space of time.

Representing short term loans that have to be repaid within a limited period of time, payday loans can be a good idea if you need access to funds fast. Payday loans are typically offered in amounts of between £50 to £1,000, but with the expectation that you’ll pay high APR charges, as well as broker fees in some instances. These kinds of loans can be useful in emergency situations, as well as when you need money for a specific reason, and know that you can make repayments in a reasonable space of time.

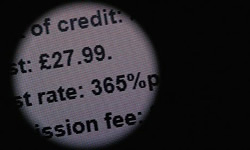

One of the main risks involved with payday loans involves having to pay charges and interest on a loan, as well as fees if you experience ongoing problems with them. In terms of interest, most payday loan companies will charge £25 per £100 you earn, meaning that if you borrow £100, you’ll have to repay £125, or £1250 if you borrow £1000. APR rates can be in the area of 1737 %, meaning that you have to think carefully about how you will be able to make repayments.

You should be aware of how much a payday loan provider will charge, and what their policy towards APR is - do they provide full and updated information on rates, or is it harder to find out what you’ll have to pay? Depending on the amount of money that you’re borrowing, the rate that you end up paying may be somewhat different than the APR advertised, which makes it important to compare the market as much as possible when deciding on the right loan for your needs.

Other charges to watch out when taking out a payday loan include fees and brokerage costs that can make it more difficult to make repayments. You may find that you’re charged for late payments, for paying before a deadline, or for going through a broker. How much you’re charged by a lending agency will depend on the amount you borrow, as well as on how quickly you can make your repayments - similar rules apply to credit cards and other sources of short term loans.

When repaying a loan, it’s crucial to be aware of any major charges that are incurred as the result of not being able to repay a loan within an agreed upon time frame. You might find that you have to take out another payday loan in order to pay off an existing one, leaving you with more debt and more risk of getting into a cycle of paying charges. In this context, you need to be wary about borrowing from more than one payday loan provider if you don’t want to get caught out.

The best payday loan companies will be transparent about what fees will be charged when you take out a loan, and will aim to put as much information as possible onto their websites so that you know what you’re getting yourself into. Specific charges for missed or underpayments can be made available, in this way, as well as processes to follow if you need to complain about being unfairly treated over your loan.

It’s worth considering the value of payday loan providers like SwiftMoney when taking out money. Swift Money offer a service where your application is forwarded onto multiple payday loan companies in order to find the best possible deal. Processing times are short, and you can expect to find transparent terms and conditions over the kinds of charges that you’ll be expecting to pay; this can include upfront information about APR and other fees, as well as calculators for working out how much you’ll be expected to repay with a loan.

Representative

Exapmle

Borrow £250 For 30 Days

| Total repayment: | £310.00 |

|---|---|

| Interest rate p.a: | 292.25%(fixed) |

| Interest payable: | £60.00 |

Representative 815.74% APR (variable)